Every year by the end of February, government agencies and departments draw up the final central government accounts, which include the annual report, budget realisation statement, income and expense account, balance sheet and notes. The State Treasury compiles the account details of agencies and departments in the central government’s Central Bookkeeping and draws up the final central government accounts based on this data.

On-budget finances comprise the revenue estimates and appropriations decided for the central government budget by Parliament. The final central government accounts are prepared based on the central government’s on-budget finances data. They contain the budget realisation statement, income and expense account, balance sheet, financial statement and notes.

The visual representation is based on the calculations in the 2022 final central government accounts, and the review focuses on the central government’s on-budget finances. In the visual representation of the final accounts, the figures are rounded to the nearest EUR 0.1 billion. When using visual representations prepared by the State Treasury, the original source and the date of the version must always be listed. For example:

- © State Treasury (more precise expression of time)

- Includes / the image is based on materials of the State Treasury (more precise expression of time)

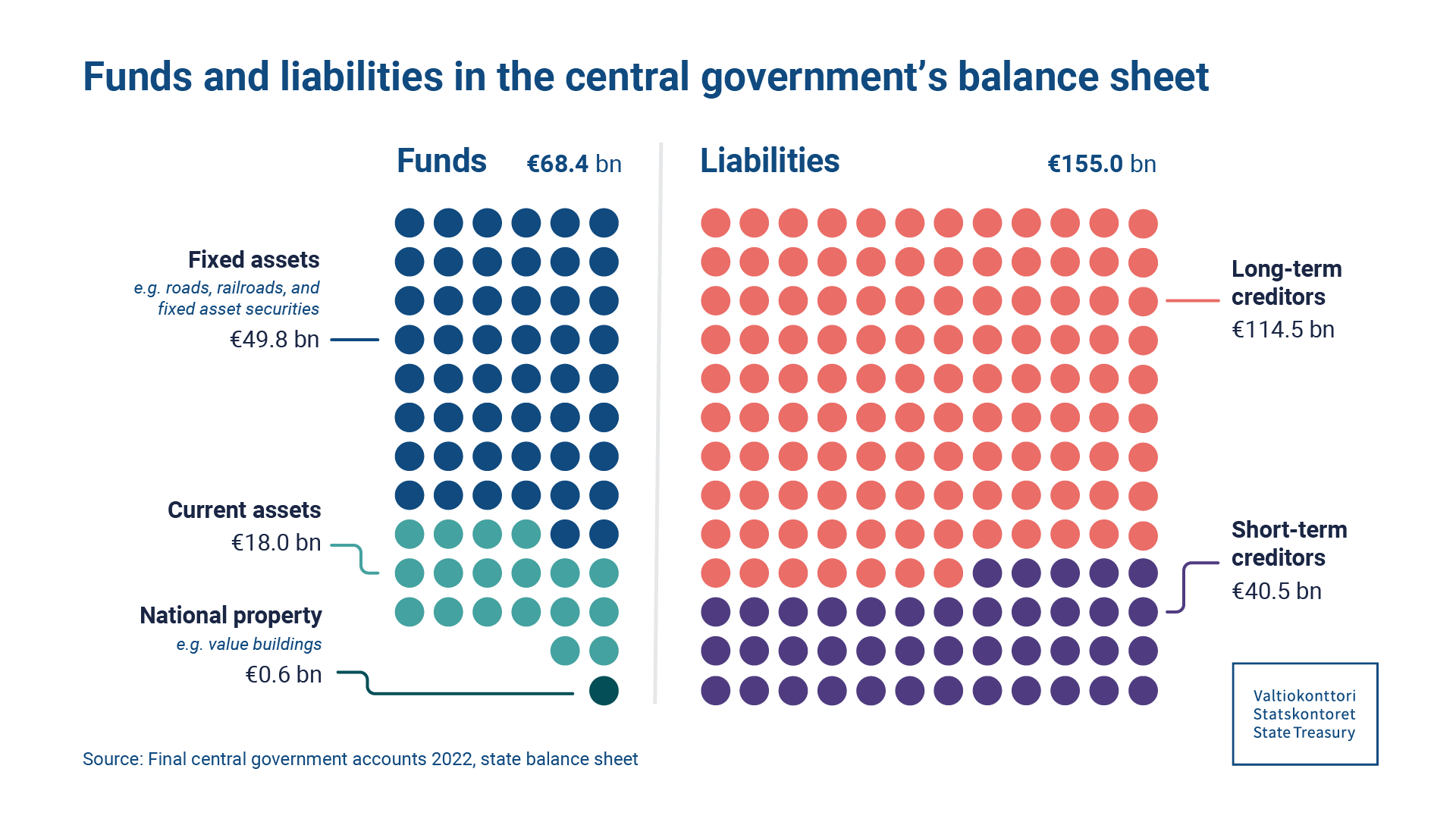

In 2022, the balance sheet total of central government finances of the Finnish government amounted to EUR 68.4 billion. This is about EUR 6.9 billion, or about 11%, higher than in the previous year. The biggest changes in the balance sheet were changes in central government debt and other euro-denominated investments. According to the balance sheet, central government debt totalled EUR 143 billion at the end of 2022, compared with EUR 131 billion at the beginning of the same year. In addition to long-term debt, central government debt in accordance with the balance sheet refers to short-term debt items as well as instalments and short-term euro-denominated loans to be paid in the following financial year.

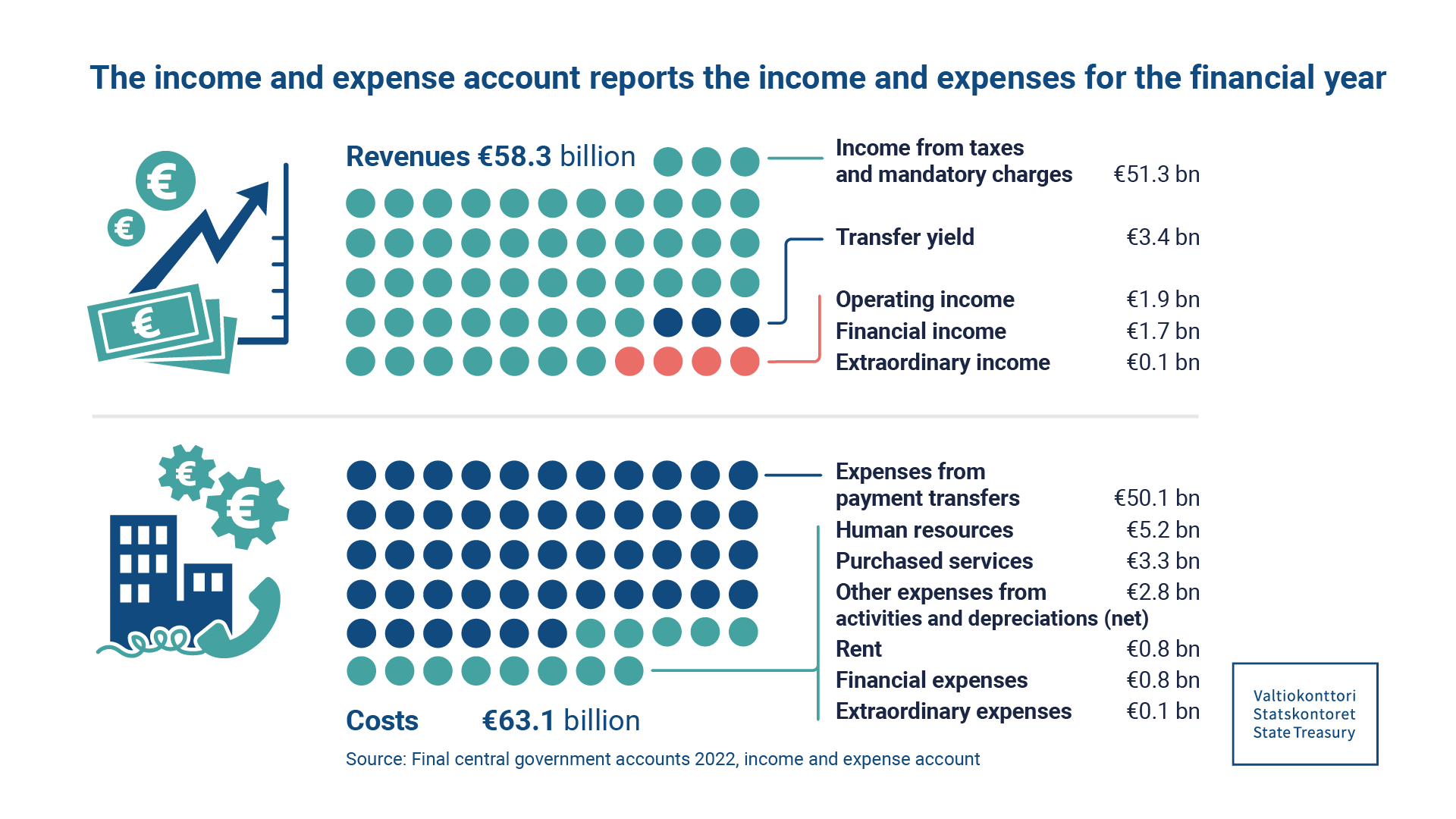

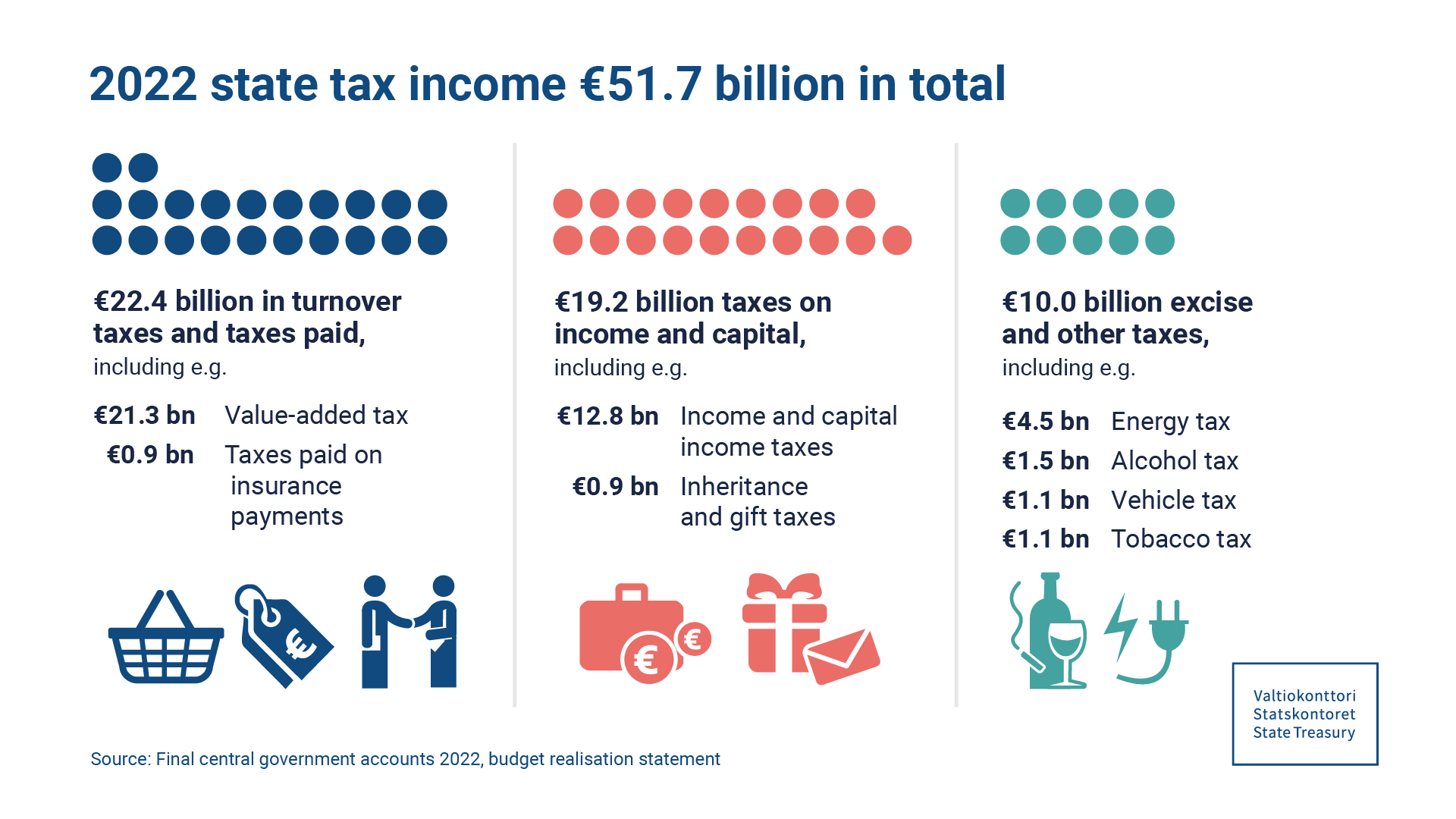

According to the central government’s income and expense account, the deficit for 2022 is EUR 4.8 billion, while the deficit for 2021 was EUR 6.3 billion. This change was particularly affected by an increase in tax revenue.

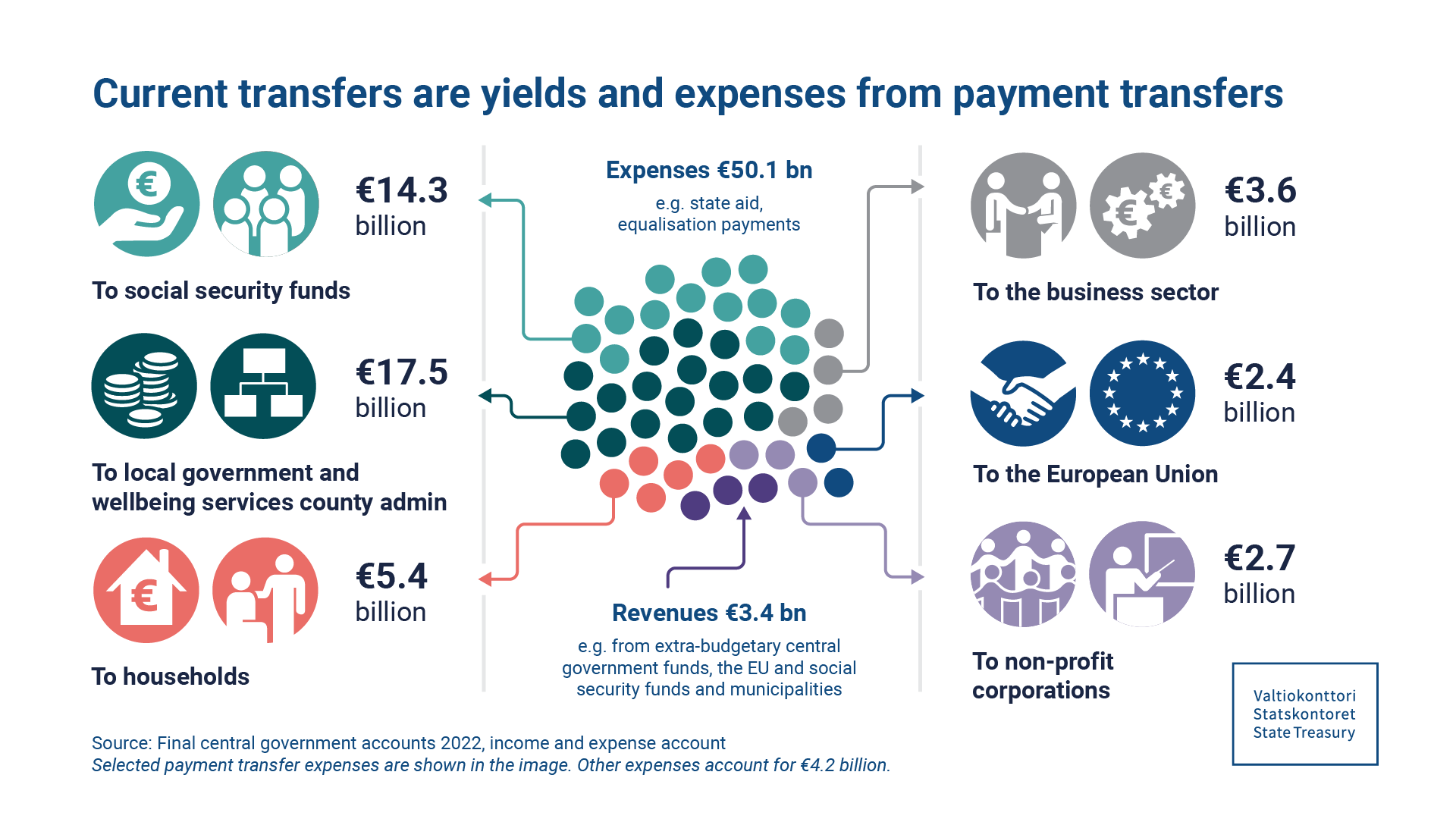

What are payment transfers?

Revenues and expenses from payment transfers do not involve a direct consideration. However, tax revenues are presented as separate revenues in the final accounts. Revenues from payment transfers include e.g. financial contributions received from European Union (EU) Structural Funds that are gross budgeted in the central government budget.

The central government transfers and grants paid to municipalities and social security funds fall under payment transfer expenses. The payment transfer expenses accounted for 79% of all expenses, which means a total of EUR 50.1 billion. This is about EUR 1.8 billion more than in the previous year. In accordance with the exception on the payment of funding for wellbeing services counties, the central government paid half of the January instalment of funding for wellbeing services counties in 2023, or EUR 2.2 billion, to the wellbeing services counties in December 2022. The amount was recorded by the state as an expense for 2022.

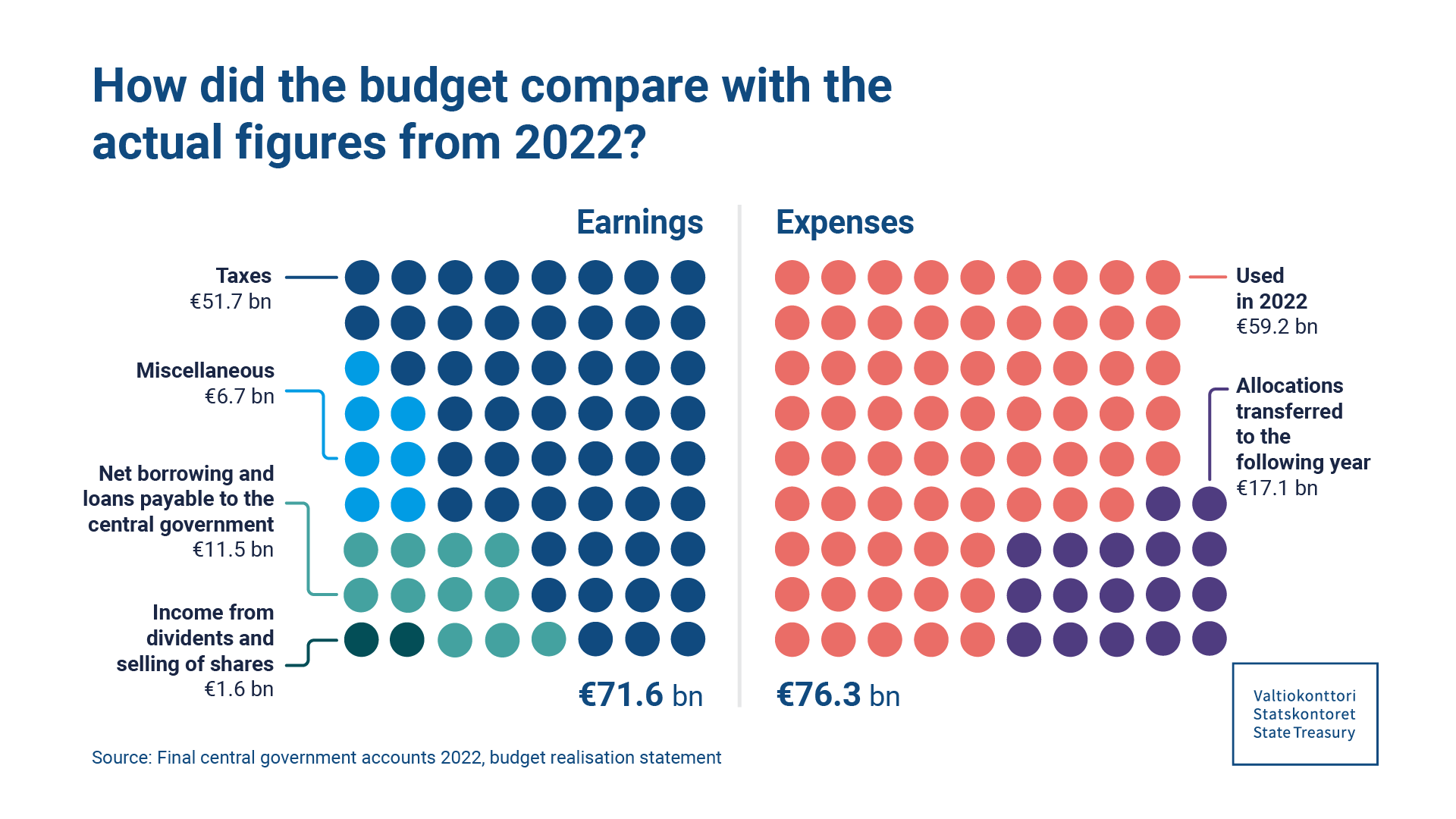

The deficit of the budget realisation statement according to the state accounts for 2022 is EUR 4.7 billion. The deficit decreased by EUR 0.6 billion from the previous year. Net borrowing, on the other hand, increased by EUR 7 billion compared to previous year.

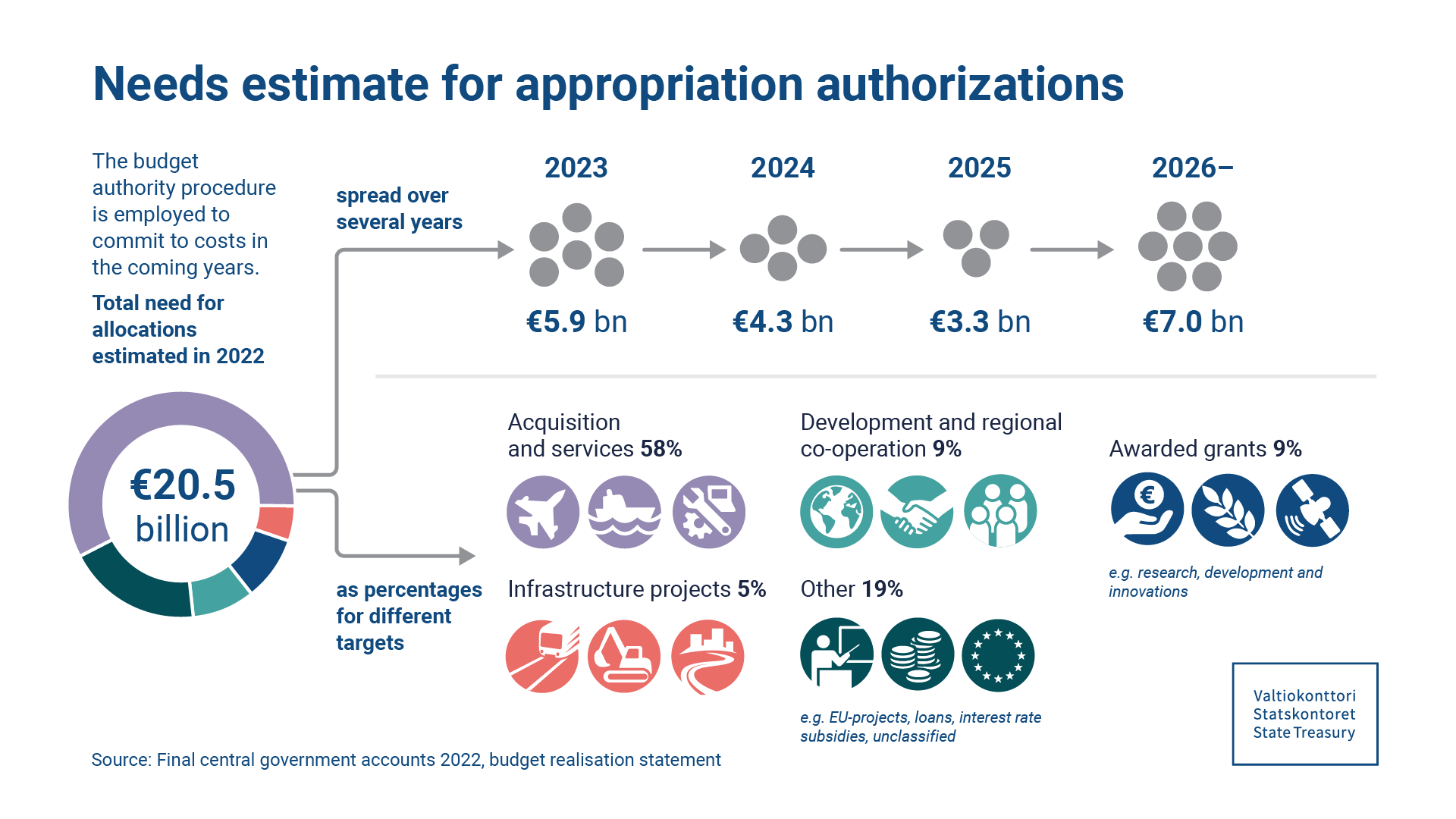

Monitoring of authorisations as part of the monitoring of budget realisation

In conjunction with the processing of the budget, Parliament can also grant an authorisation that is limited in terms of quantity and purpose of use for making agreements and commitments. The appropriations required for the expenses incurred from this are included in the budgets for later years either in full or for the missing parts. An authorisation can be used during the financial year for which it is granted in the financial year’s budget. The exercise of the authorisation shall mean the conclusion of agreements and commitments for which the authorisation has been granted in the budget.

The centralised monitoring of authorisations is carried out by the State Treasury. In addition to the needs for appropriations mentioned here, the central government also has needs for appropriations that arise from other commitments. These are described in e.g. Appendix 12 to the final central government accounts.

Parliament receives reports of the budget’s realisation

Operational and financial planning links the tasks and goals of the central government and ministries, as well as the operational tasks of government agencies, to each other. Each year in May, the Government submits the Government’s annual report to Parliament. It reports on Government activities, the management of central government finances and adherence to the budget. The report also includes descriptions of the performance of ministries, the final central government accounts and replies to parliamentary statements and position papers.

Further information:

Central Government Accounting, tel. + 358 (0)295 50 2000, kkp(at)valtiokonttori.fi